Latest STAAH report highlights traveller preferences and hospitality distribution trends across Malaysia, Vietnam, Singapore, Indonesia, Philippines, and Thailand.

STAAH, a global hospitality technology leader, has released its Top Booking Channels for Southeast Asia for 2025, identifying the booking platforms driving the highest booking volumes across one of the world’s fastest-growing travel regions. The ranking, based on bookings processed between January and December 2025, showcases shifting traveller behaviour, strong intra-regional travel demand and the growing influence of mobile-led booking patterns.

Across Southeast Asia, Booking.com emerged as the leading channel, with Agoda, Trip.com and Expedia following closely due to their strong regional presence and ability to meet the needs of mobile-first travelers. Traveloka remains a significant regional contender, particularly in Indonesia and the Philippines. STAAH SwiftBook continued gaining traction as hotels invested in direct channel optimisation. China’s outbound market is driving up Dida Travel and Trip.com stronghold in the region while MG Group and kliknbook growth reflects the importance of B2B market.

Country highlights at a glance

Malaysia

Malaysia recorded a strong year for digital travel bookings, with Agoda and Booking.com dominating due to broad accommodation choices and competitive regional pricing. Domestic travel continued thriving on the back of improved road and air connectivity. Direct bookings showed steady growth as boutique and independent hotels adopted enhanced digital strategies. Dida Travel, with its strong hold on China outbound market made an entry into Malaysia’s top 10 along with Airbnb.

Vietnam

Vietnam saw significant growth in online travel agent (OTA) usage, with Agoda and Booking.com leading thanks to competitive pricing and expanding hotel availability. Trip.com, Expedia and Traveloka held their ground in the competitive Vietnamese travel market while GoMMT was a new entrant. Key destinations like Da Nang, Hanoi and Ho Chi Minh City anchored the country’s booking volume.

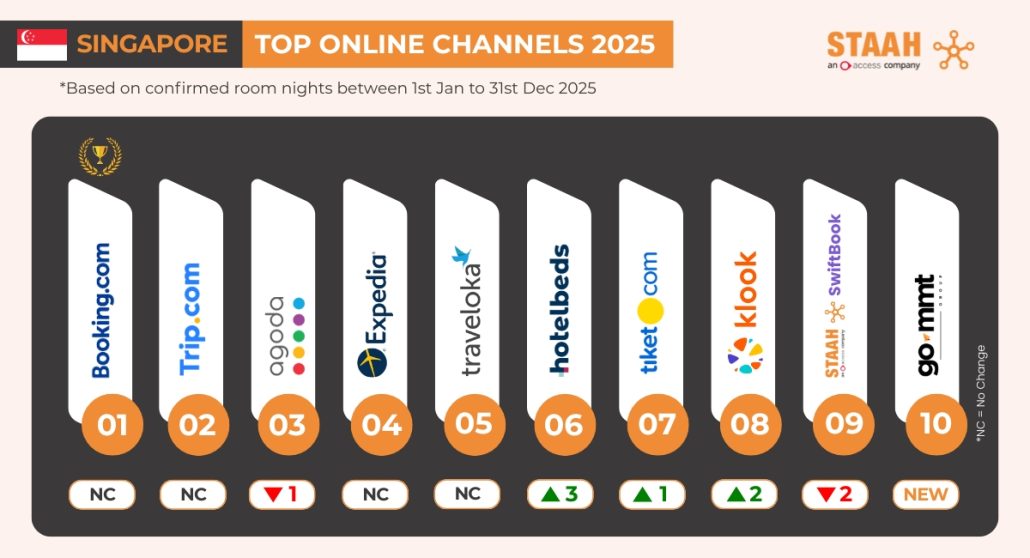

Singapore

Singapore’s premium travel market favoured Booking.com, Trip.com, Agoda, Expedia and Traveloka, driven by seamless mobile functionality and extensive accommodation choices. Business travel recovery supported consistent booking activity across online travel agents (OTAs). New entrant to the Singapore list was GoMMT signifying the impact Indian travelers are having through the region.

“In more mature digital markets like Malaysia, Vietnam and Singapore, we’re seeing travellers prioritise speed, trust and seamless mobile experiences when booking accommodation,” says Michelle Yong, Regional Head, STAAH. “While global OTAs continue to lead on visibility and conversion, hotels in these markets are becoming far more strategic about strengthening their direct channels to protect margins and build guest loyalty. The balance between reach and profitability is becoming a defining factor for success in 2025.”

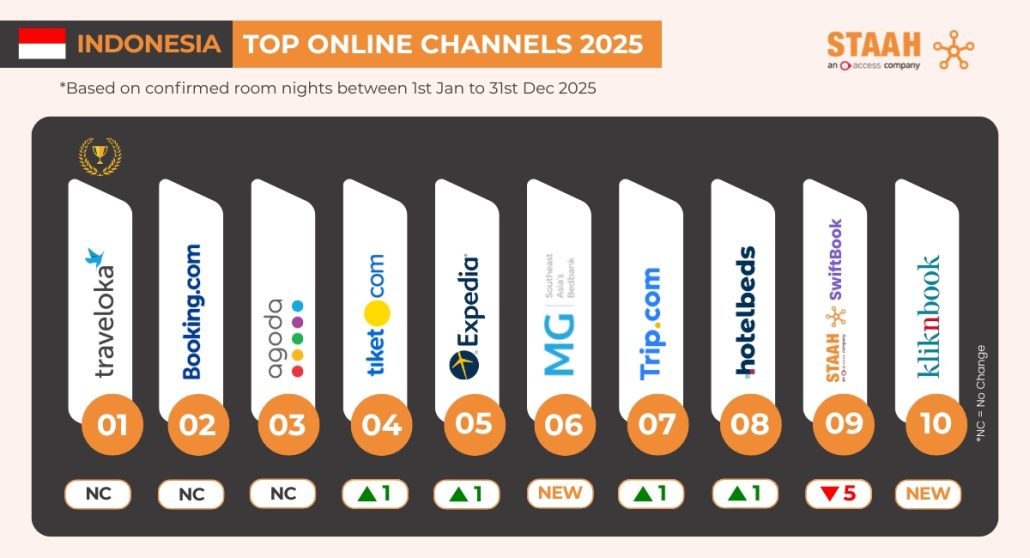

Indonesia

Indonesia’s large domestic audience strengthened Traveloka’s leadership position, especially among mobile-first consumers. Booking.com and Agoda performed strongly across Bali and resort-driven markets, buoyed by international arrivals. MG Group and kliknbook, both B2B hospitality marketplaces, made their way into Indonesia’s top 10 list. These platforms are widely recognised in the region for enabling seamless access to wide hotel inventory for travel agents and resellers, reflecting growing digital infrastructure in Indonesia’s travel tech ecosystem.

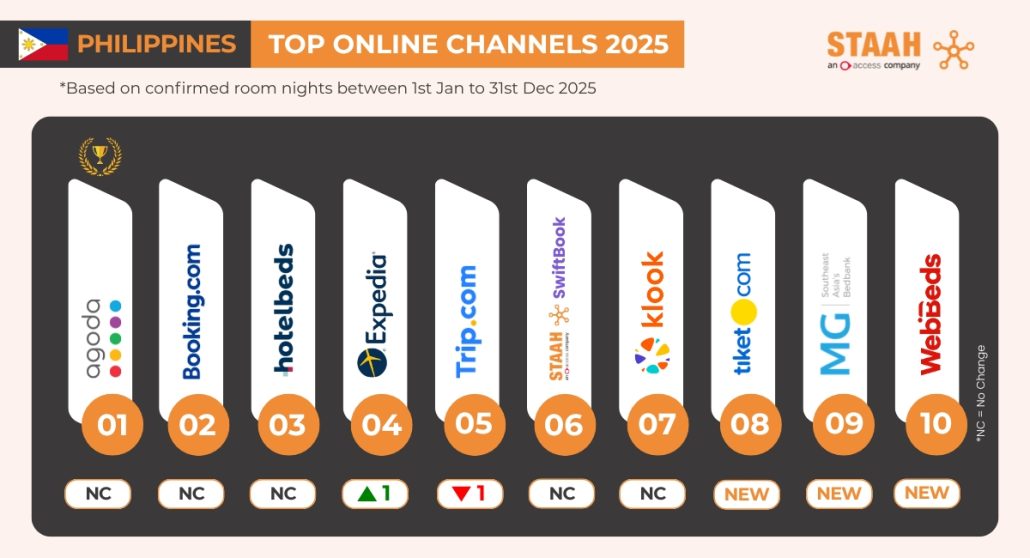

Philippines

In the Philippines, Agoda and Booking.com led booking volumes driven by demand for island destinations such as Cebu, Siargao and Palawan. Direct bookings via STAAH SwiftBook held its spot on the top 10 list for Philippines with OTAs such as trip.com or Ctrip and tiket.com continuing to bring in significant booking volumes. MG Group and WebBeds, the B2B hospitality marketplace, also made it to Philippines top 10 list showing the importance of business travel in Southeast Asia.

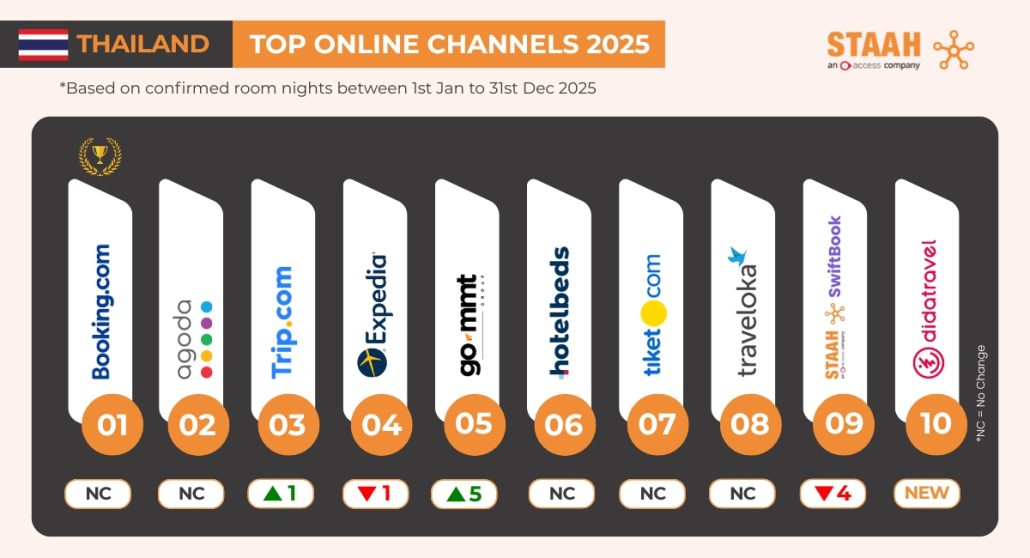

Thailand

Thailand’s diverse tourism landscape saw Booking.com at the forefront, with Agoda and Trip.com close behind in Bangkok, Chiang Mai and Phuket. A continuous influx of regional and international travellers supported multi-channel booking activity. GoMMT was the biggest gainer on the Thai list, up five positions from last year while Dida Travel broke through the list for the first time. Combined with Trip.com, Dida Travel’s entry reflects the resurging influence of Chinese outbound travel on the region.

“Indonesia, Thailand and the Philippines continue to be driven by high-volume, mobile-first travellers and strong intra-regional movement,” says Prayoga Handayaprana, Regional Head – Indonesia, Thailand and Philippines, STAAH. “Local platforms and regionally strong OTAs play a critical role alongside global players, especially in resort and leisure-led destinations. What stands out in 2025 is how hotels are diversifying their channel mix to stay visible across leisure, wholesale and business travel segments.”

About the STAAH Channel Insights Report

The annual STAAH rankings are derived from anonymised booking data processed through STAAH’s distribution and direct channel platforms. The report provides hoteliers with clear insights into regional booking behaviour and channel performance to support smarter revenue strategies.

Integrate with 2,000+ partners worldwide to expand your reach