Latest booking data from STAAH reveals regional insights highlight evolving traveller behavior across three distinctive hospitality markets.

STAAH, a global hospitality technology provider, has released its Top 10 Booking Channels for 2025 across the United Kingdom, Middle East, and Sri Lanka based on booking performance from January to December 2025.

These rankings reflect the very different dynamics driving traveller demand across mature, boutique and fast-expanding tourism markets.

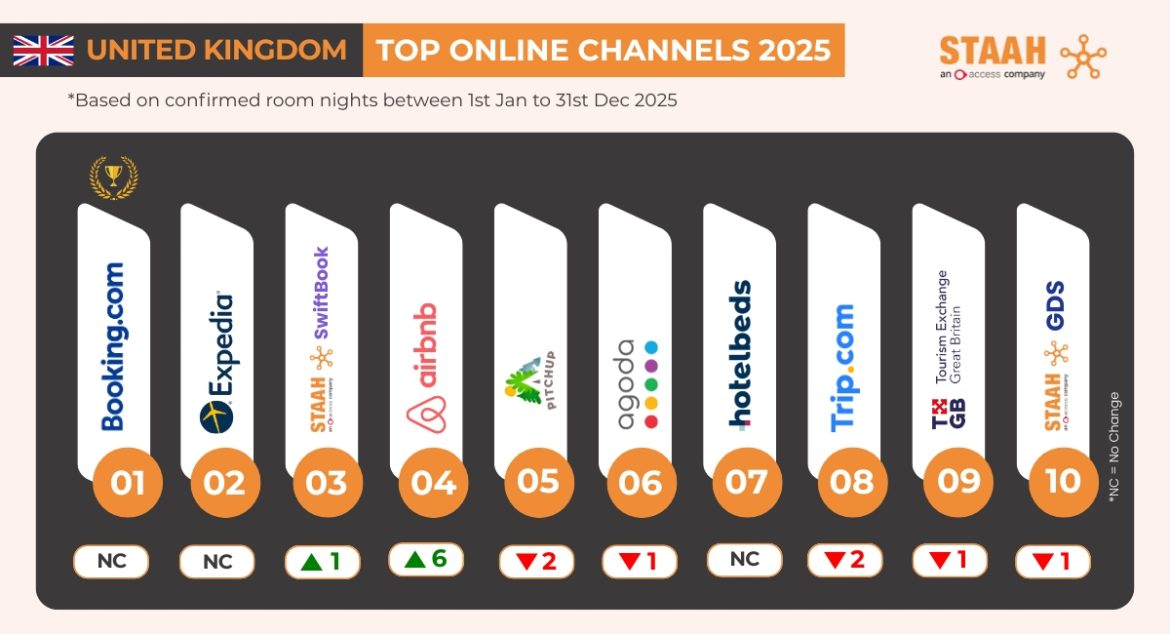

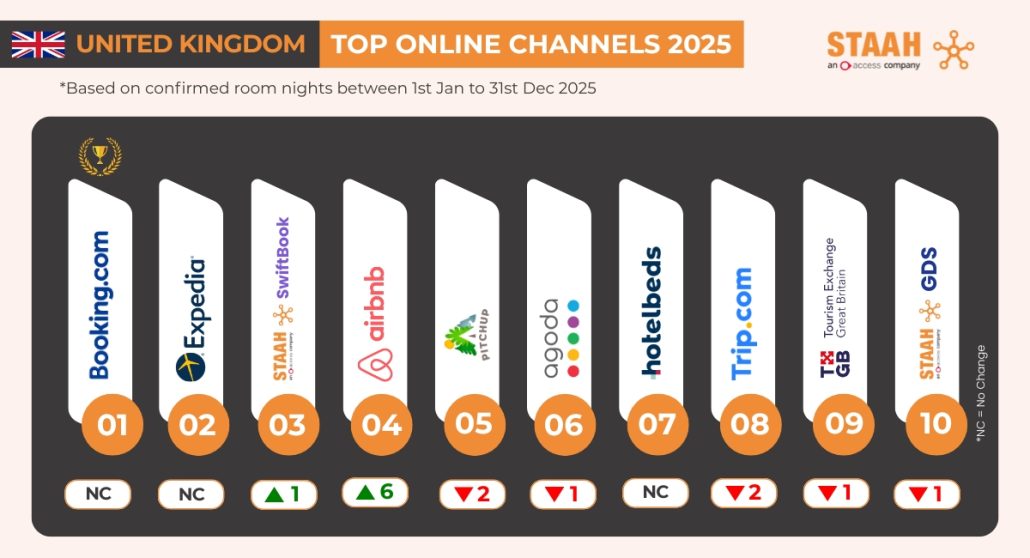

United Kingdom

The UK market remains strongly influenced by global online travel agents (OTAs) and specialist platforms, with Booking.com continuing to dominate national booking volumes due to its extensive property coverage and loyalty-driven user base. Expedia maintained its solid presence, particularly among corporate and international travellers. Airbnb was the biggest gainer, up six positions from last year.

STAAH SwiftBook made meaningful progress in the direct channel space as UK properties focused on margin protection and brand-led guest experiences. Niche and lifestyle-driven channels such as pitchup.com and Hotelbeds maintained their presence on the top 10 list, reflecting the UK’s highly diverse accommodation landscape.

Middle East

The Middle East market displayed one of the most diverse booking ecosystems in the 2025 rankings. Booking.com remained firmly in the top position, supported by strong inbound and business travel flows. Agoda and Expedia continued expanding its footprint, fuelled by increased regional tourism and competitive leisure offers while GoMMT made its first entry into the top 10 list for Middle East region.

STAAH SwiftBook maintains a top 10 position while niche travel sites such as WebBeds, EET Global and HalalBooking remain hugely relevant to hoteliers in this part of the world.

Sri Lanka

Sri Lanka’s channel mix in 2025 highlights the country’s strengthening tourism rebound, led once again by Booking.com, which delivered significant volumes across coastal and heritage destinations. Agoda performed particularly well among regional Asian travellers seeking competitive package rates.

Direct bookings via STAAH SwiftBook continued rising as boutique hotels and villas leaned into personalised guest acquisition. International wholesalers such as Hotelbeds and WebBeds contributed meaningfully to group and long-stay travel, while platforms like Trip.com and Airbnb remained important for their niche segments. GoMMT, which is expanding fast in the region, was the biggest gainer, up three positions from last year.

“These three markets showcase very different booking behaviours, from the UK’s mature and experience-led accommodation sector, to the Middle East’s highly segmented and culturally attuned distribution landscape, to Sri Lanka’s revival-driven mix of OTAs and wholesalers” says Adam Walsh, Head of Connectivity at STAAH.

“Across all three regions, the most successful properties are those taking a balanced approach to distribution. OTAs continue to provide scale and market reach, while direct channels are delivering deeper guest relationships and stronger margins. Hotels that combine the strengths of both are the ones outperforming in 2025.”

About the STAAH Channel Insights Report

The annual STAAH rankings are derived from anonymised booking data processed through STAAH’s distribution and direct channel platforms. The report provides hoteliers with clear insights into regional booking behaviour and channel performance to support smarter revenue strategies.

Integrate with 2,000+ partners worldwide to expand your reach