Direct booking strength, diversified online travel agent (OTA) usage and niche platforms shape hospitality bookings across the two markets.

STAAH, a global hospitality technology company, has released its 2025 Top Hotel Booking Channels for Oceania, covering New Zealand and Australia, based on booking data processed between January and December 2025. The findings spotlight the evolving distribution strategies of accommodation providers across two of the Pacific’s most mature and digitally advanced travel markets.

Across New Zealand and Australia, Booking.com remained the leading source of completed bookings, supported by high traveller trust, broad inventory options and strong performance across both leisure and corporate segments. Direct bookings through STAAH SwiftBook continued to rise, reflecting hoteliers’ increased focus on commission savings and brand-driven guest engagement. Meanwhile, OTAs such as Expedia, Agoda, Trip.com and niche channels including Airbnb, Hostelworld, and regional wholesalers played vital roles in attracting a wide mix of domestic and international travellers.

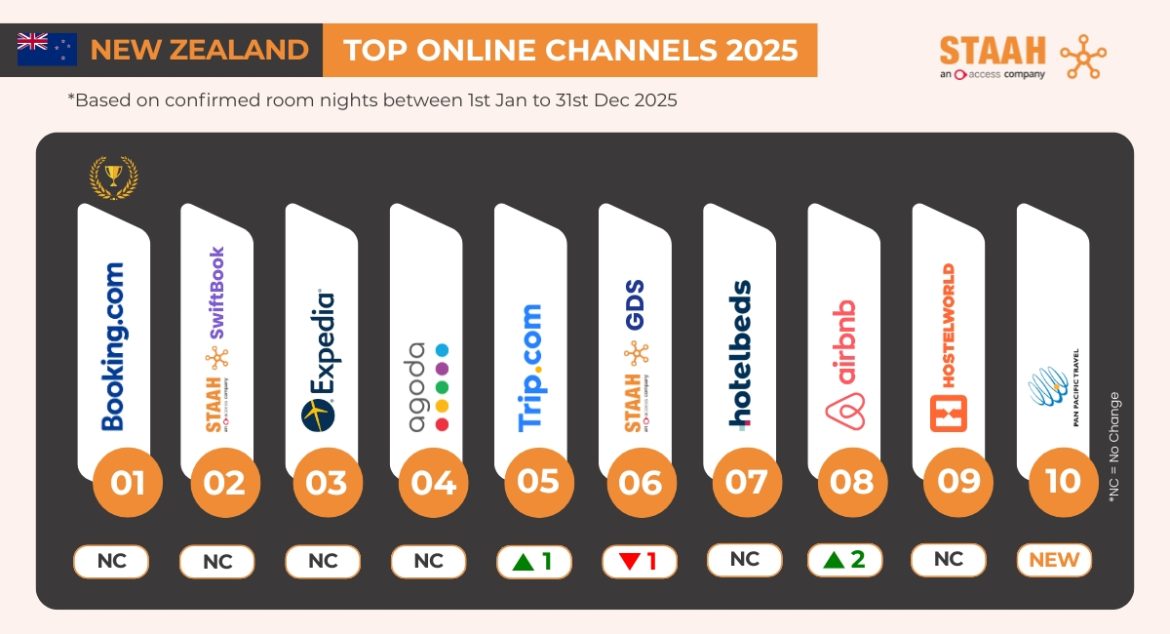

New Zealand Highlights

New Zealand’s booking landscape in 2025 reflects balanced demand between international visitors and an active domestic market. Booking.com led the rankings, followed by STAAH SwiftBook, which continued to gain traction as properties emphasised personalised guest relationships and direct conversion.

Expedia and Agoda remained strong contributors along with Airbnb, that rose up two positions from last year. The importance of Chinese tourism on New Zealand market plays out with Trip.com or Ctrip presence on the New Zealand STAAH Top 10.

Hostelworld continued to attract younger and experience-focused travellers, while STAAH GDS and Hotelbeds supported corporate and wholesale demand across major cities.

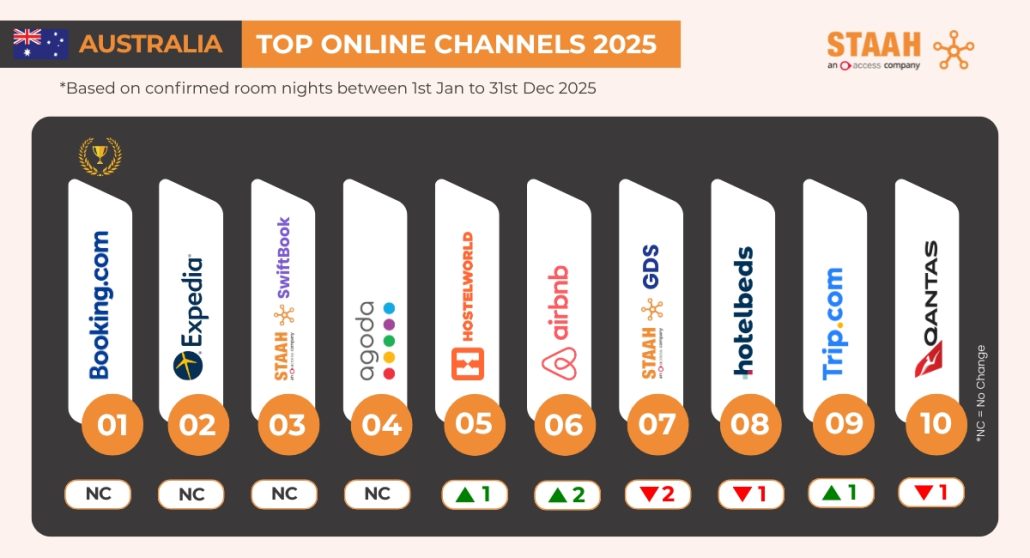

Australia Highlights

Australia’s accommodation sector saw a strong year fuelled by continued domestic travel and solid inbound demand. Booking.com held the top position, while Expedia performed strongly across corporate and leisure traveller segments.

STAAH SwiftBook maintained its stronghold as hotels continued to invest in direct booking capability, especially among independent and boutique operators. Agoda, Hostelworld, and Airbnb also held notable share, reflecting Australia’s appeal across diverse traveller categories, from backpackers and families to premium leisure visitors.

Wholesalers such as Hotelbeds and OTA like Qantas contributed meaningfully to group, wholesale and niche travel flows while STAAH GDS in the top 10 list reflects the importance of this channel to attract the lucrative corporate market.

“New Zealand and Australia are mature, highly competitive travel markets, and their 2025 results show the value of a diversified distribution mix. OTAs continue to bring tremendous reach, while the growth of direct bookings signals hoteliers’ increasing commitment to building brand control and guest loyalty,” says John Clune, Head of Sales – Oceania from STAAH.

About the STAAH Channel Insights Report

The annual STAAH rankings are derived from anonymised booking data processed through STAAH’s distribution and direct channel platforms. The report provides hoteliers with clear insights into regional booking behaviour and channel performance to support smarter revenue strategies.

Integrate with 2,000+ partners worldwide to expand your reach