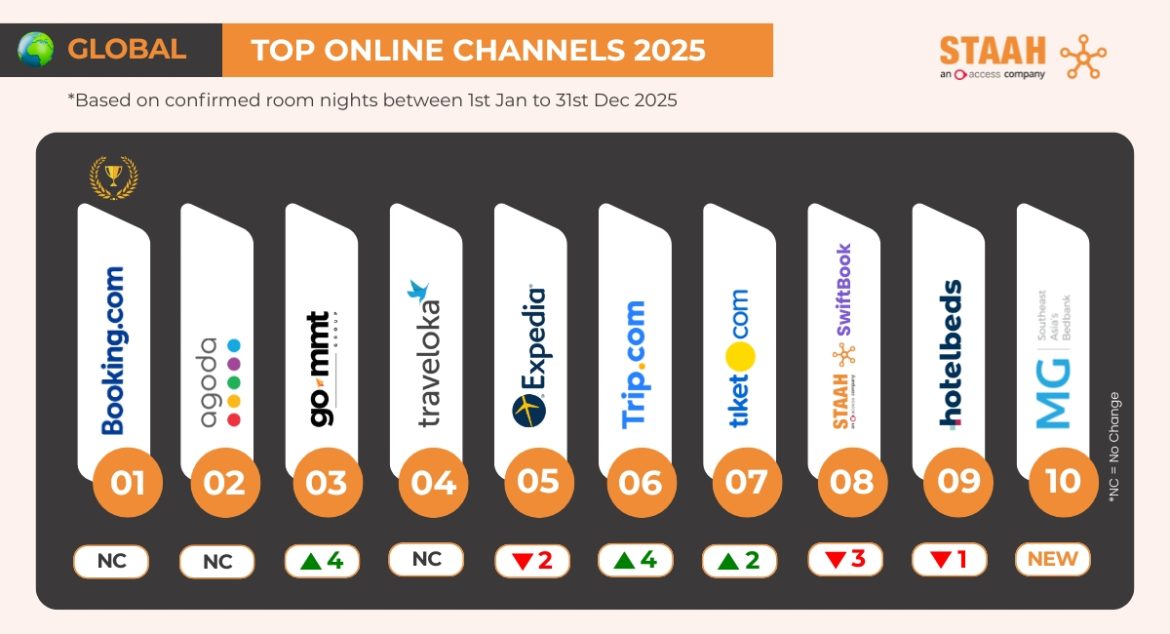

Cross-market review reveals the rising influence of direct bookings, diversified OTA usage and region-specific travel behaviors worldwide.

STAAH, a global leader in hospitality distribution and booking technology, has released its 2025 Global Top Booking Channels Summary, consolidating insights from key regions including India, Southeast Asia, Australia, New Zealand, the United Kingdom, Middle East, and Sri Lanka. The findings reflect a year of strong recovery, growing digital maturity and a clear shift toward balanced distribution strategies in the global accommodation sector.

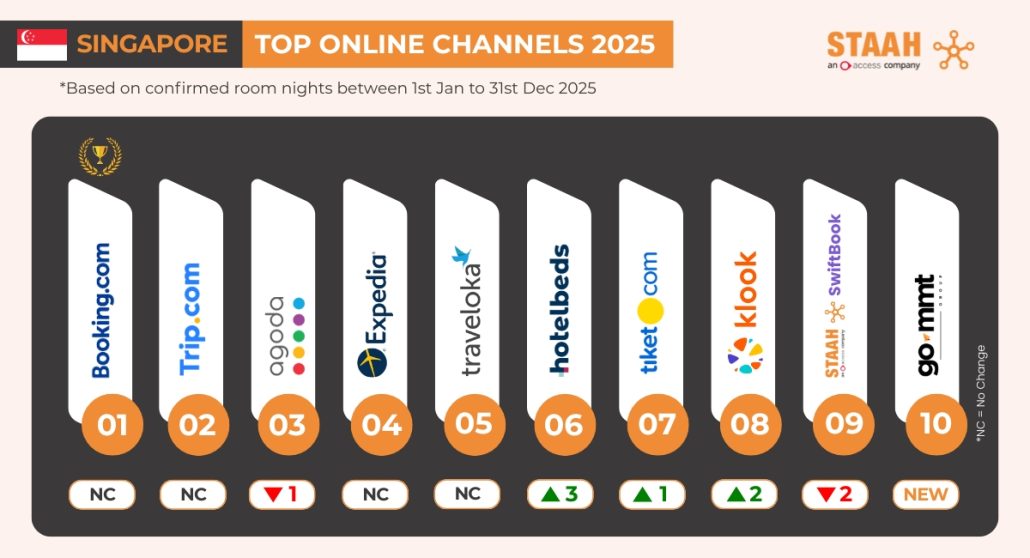

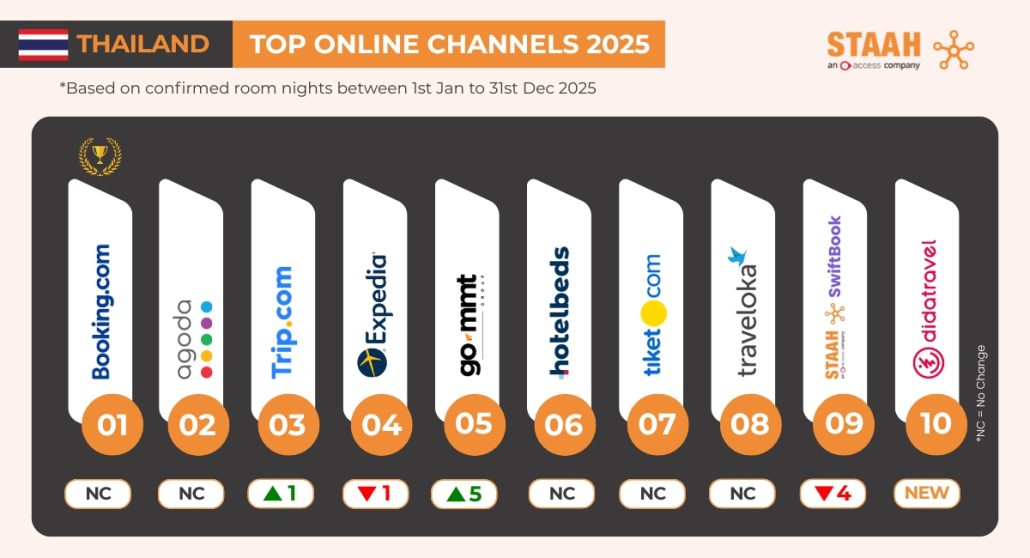

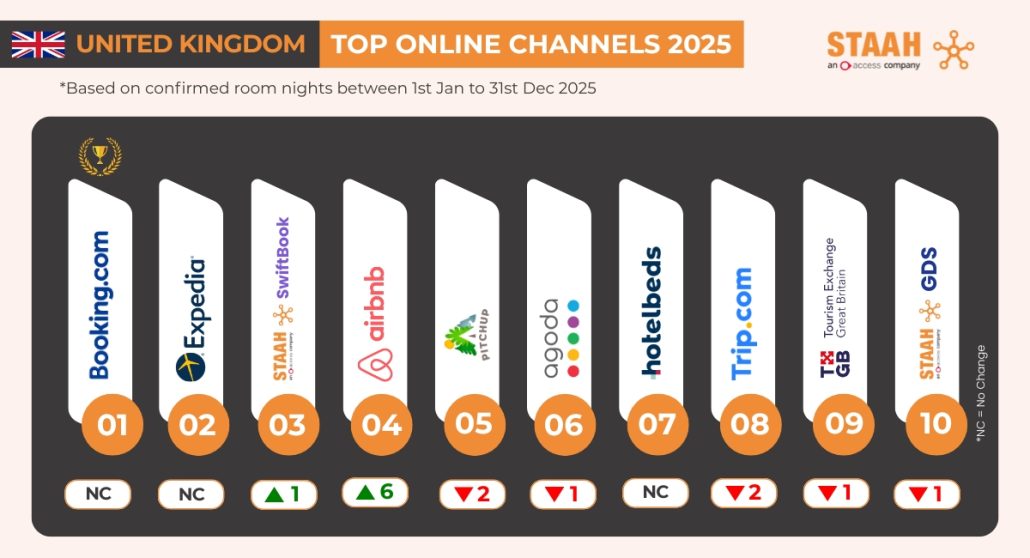

Across nearly all markets, Booking.com retained its position as the leading online travel agent (OTA), driven by its global reach, user trust, extensive loyalty programme and ongoing investment in mobile-first experiences. Agoda, Expedia, Trip.com, and regional players such as Traveloka and GoMMT, also delivered substantial booking volumes, underscoring the strength of multichannel distribution in an increasingly competitive landscape.

A notable trend across continents was the continued rise of direct bookings, with STAAH SwiftBook consistently ranking within the top-performing channels. Hotels worldwide are actively strengthening their direct strategies through improved website experiences, member-only incentives and brand-led guest engagement. This shift signals a global desire among hoteliers to improve revenue efficiency and build long-term guest relationships.

B2B and wholesale providers such as Hotelbeds, MG Group, WebBeds, and niche regional platforms also played a critical role in markets reliant on group travel, packaged experiences and long-stay itineraries. Their presence in the top rankings reflects the complexity and segmentation of today’s global travel ecosystem.

Regionally, key themes emerged:

- India demonstrated strong domestic OTA loyalty led by GoMMT, paired with a noticeable rise in direct bookings.

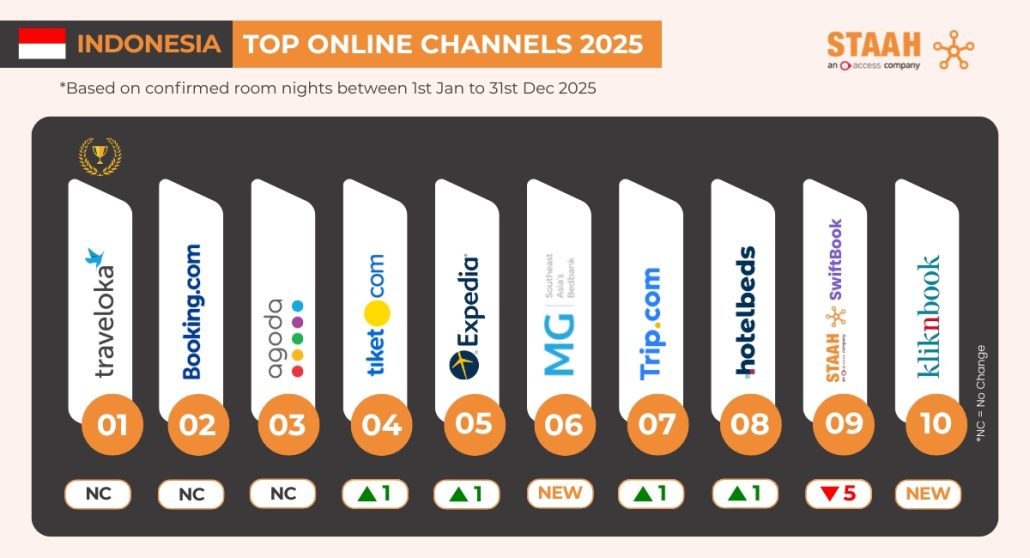

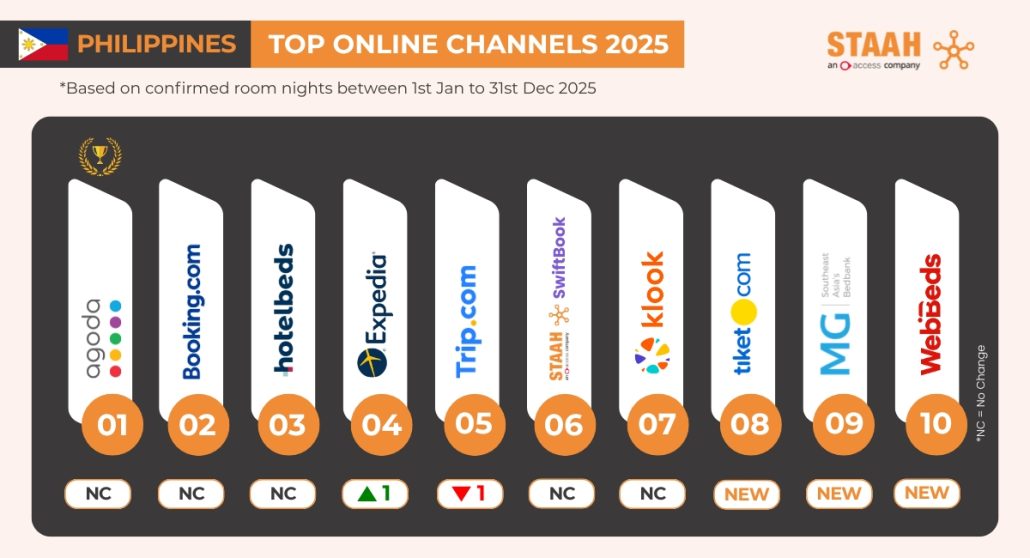

- Southeast Asia showcased mobile-driven behavior, with Agoda, Booking.com and Traveloka excelling across diverse travel segments.

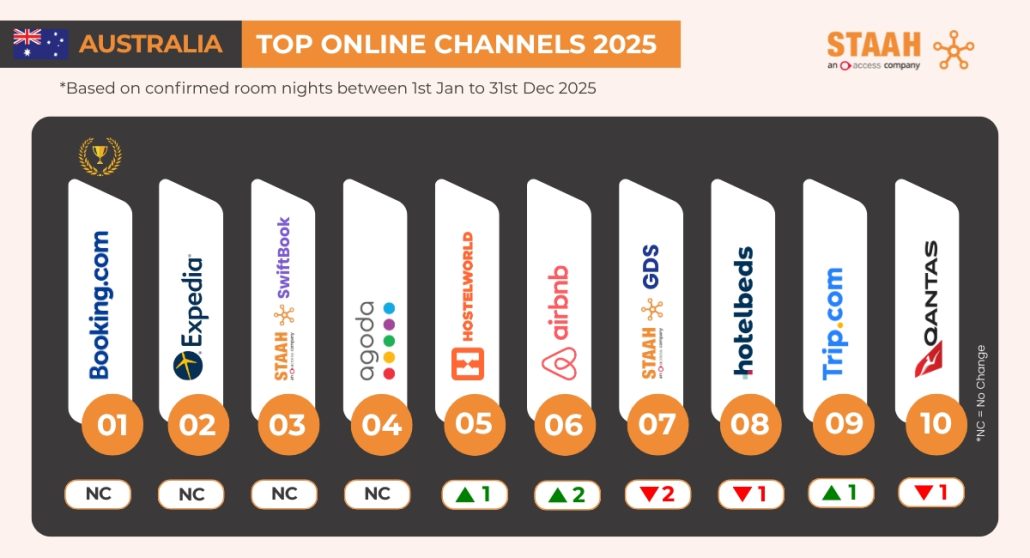

- Australia and New Zealand depicted balanced demand across OTAs, wholesalers, alternative-stay platforms and direct channels.

- The UK showed strong maturity, with a mix of large OTAs and niche lifestyle platforms shaping booking flows.

- The Middle East demonstrated a highly segmented channel mix, including culturally aligned platforms such as halalbooking and eetglobal.

- Sri Lanka benefited from revived inbound tourism supported by OTAs and wholesalers, with direct channels gaining strength.

Together, these insights reveal a marketplace where no single channel dominates universally, hotels are increasingly relying on a strategic blend of distribution partners to reach different traveller types and booking journeys.

“Our 2025 global findings highlight the importance of balance and flexibility. Different markets rely on different channels, but the strongest performers are the ones that treat distribution as a strategic ecosystem rather than a single source of demand,” says Tarun Joukani, Director at STAAH. “OTAs continue to provide much-needed reach, B2B channels unlock specialised demand, and direct bookings deliver long-term value. The hotels that integrate all three effectively are the ones leading the way in 2025.”

Australia

India

Indonesia

Malaysia

Middle East

New Zealand

Philippines

Singapore

Sri Lanka

Thailand

United Kingdom

Vietnam

About the STAAH Channel Insights Report

The annual STAAH rankings are derived from anonymised booking data processed through STAAH’s distribution and direct channel platforms. The report provides hoteliers with clear insights into regional booking behaviour and channel performance to support smarter revenue strategies.

Integrate with 2,000+ partners worldwide to expand your reach