Unlike the old summer-vacation-centric model many regions follow, hotels across much of Asia are seeing that year-end isn’t just a lull, it’s becoming a meaningful booking period.

According to recent data, many markets in the region recorded increases in RevPAR (revenue per available room) during December, clearly signalling that year-end hotel demand Asia is strengthening even though December is “traditionally the slowest month” for many hotels.

Several factors are driving this shift. Asia hotel demand trends now reflect increasing regional mobility, better air connectivity, more holiday and leisure travel, and growing guest expectations for experiences, which means even “off-peak” months carry potential value.

For hotel decision-makers, that means Q4 hotel performance Asia (and “year end”) is no longer a “cleanup month”, it’s a strategic opportunity.

Asia Hotel Demand Trends: What the Data Is Showing?

1. Mixed but Often Resilient – Rate & Occupancy Performance

- As of 2025, there’s significant divergence by segment: luxury and upper-upscale hotels are more resilient, while mid-market and economy-tier hotels face greater pressure.

- In H1 2025, some markets recorded strong ADR (average daily rate) growth, for example, Japan saw a ~17% increase.

- In other markets, ADR and occupancy remain under pressure, or growth has flattened.

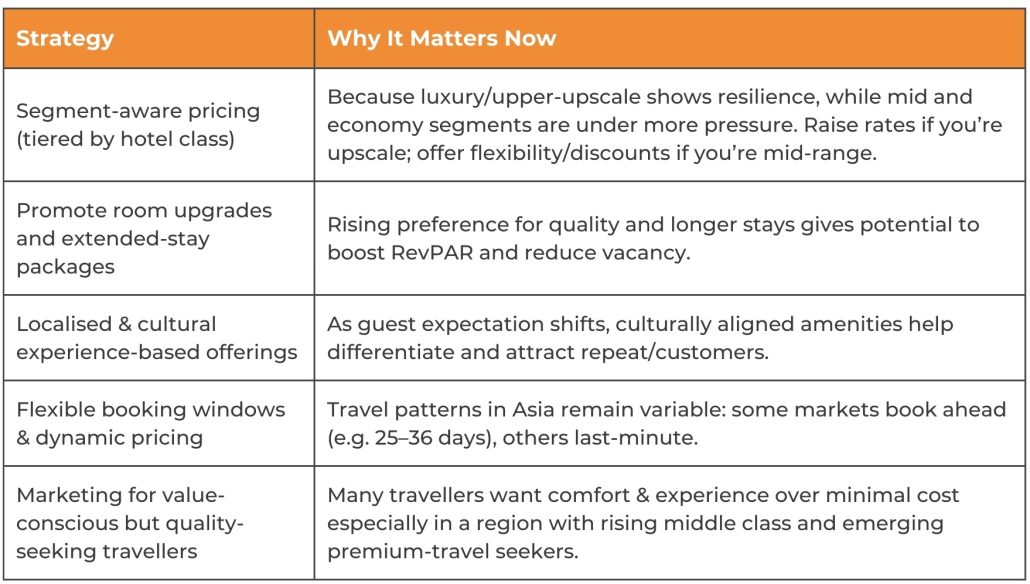

Implication: “One-size-fits-all” pricing strategy don’t work anymore. Year-end planning must consider your market, competitive set, and hotel segment.

2. Shift Toward Premium / Upscale & Longer Stays

According to recent industry insights, more travellers especially in Asia are opting for “non-standard” or upgraded rooms (Superior or Luxury) rather than budget or standard rooms, a shift that directly supports stronger Asia Pacific hotel RevPAR trends and higher overall revenue potential in key source markets like China, Indonesia, and India.

Moreover, there’s a rising demand for longer stays or “extended stay” behavior, which opens opportunities for hotels to position mid-to-long stay offers, packages or discounts for guests staying more than just a weekend.

Implication: Hotels should consider promoting upgraded room categories and extended-stay packages toward year-end, especially targeting value-seeking but quality-sensitive travellers.

3. Guest Preferences Lean Heavier on Localisation, Culture & Experience

Travelers across Asia increasingly value culturally fluent and localized experiences from language, payment methods, to food and in-hotel services. Hotels that adopt advanced localisation strategies see higher guest satisfaction, more repeat bookings, and stronger performance.

Food, F&B experiences, wellness, and experiential local culture are big drivers of bookings beyond just “a bed for the night.”

Implication: As hotel operators and decision-makers, leaning into local culture, experiential stays, and “feel-at-home” amenities can pay off especially at year-end when travellers seek comfort, value, and authenticity, helping lift Asia hotel occupancy and ADR in competitive markets.

What It Means for Revenue Management & Hotel Strategy (for Q4 / Year-End)

Risks & What to Watch Out For

1) Segment Imbalance: If you’re operating a mid- or economy-tier hotel, you may be squeezed by soft ADR and rate competition. Relying only on occupancy could hurt profitability.

2) Supply Growth Pressure: In many Asian markets new hotel supply and branded hotel expansions continue. More supply = higher competition, which puts pressure on mid-market hotels.

3) Changing Booking Behavior & Lead Time Uncertainty: Depends strongly on guest origin and purpose (business vs leisure). Dynamic pricing and flexible cancellation policies become critical.

Asia Pacific Hotel Performance 2025: Strategic Recommendations for Hoteliers

1) Review your segment positioning: upscale vs mid vs economy and adjust year-end rate-setting accordingly. If you’re upscale, consider tight occupancy controls plus modest rate increases to capture growing year-end hotel demand Asia. If mid/economy, tighten costs and offer value-add deals or packages that convert price-sensitive but experience-driven guests.

2) Design and promote “experience + culture” packages rather than just “room + bed.” To align with evolving year-end booking patterns in Asia, think wellness, local cuisine, cultural touches, and extended-stay benefits, especially attractive for business travellers extending stays or long-stay leisure travellers.

3) Adopt dynamic pricing and re-evaluate booking window strategies. Use data to track where your bookings are coming from (local, regional, international) and how far in advance, then tailor pricing and promotions accordingly.

4) Focus on direct bookings & personalised experiences. With guest expectations rising for localisation and personalisation, hotel websites or loyalty programmes may yield higher value than generic OTA-driven traffic.

5) Watch supply trends and competitive positioning with many new developments and brand-expansions in Asia, staying relevant requires differentiation (experience, service, localisation, flexibility).

The notion of “year-end slowdown” is no longer universal across Asia. For many hotels, especially in upscale, culturally aligned, experience-first segments, Q4 now reflects strong year-end hotel demand Asia, becoming a strategic sweet spot to salvage occupancy, maximise revenue, and build loyalty among travellers who value more than just a bed.

If you approach year-end with data-driven pricing, smart segmentation, and guest-centric offerings, the end of the calendar year can become one of your strongest quarters, not a cleanup week.